Don’t Buy Big Beer’s Blather

Don't Buy Big Beer's Blather

Get the facts on big beer’s disinformation campaign.

Adult alcohol consumers are overwhelmingly choosing spirits, and the Distilled Spirits Council is working hard to advocate for laws that ensure consumers can purchase their favorite spirits when, how and where they want. Big beer, on the other hand, is waging a disinformation campaign about the spirits industry in an effort to block competition and consumer choice in the marketplace. Fortunately, their anti-consumer efforts are just a bunch of blather. We #StandWithConsumers! Read below to find out how.

FACT:

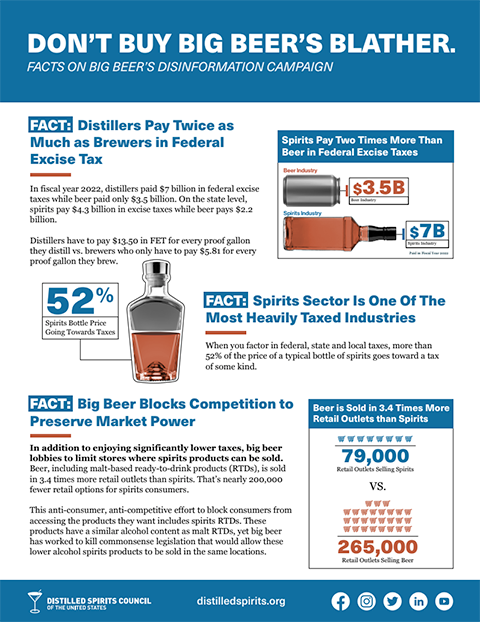

Distillers Pay Twice as Much as Brewers in Federal Excise Tax

In fiscal year 2022, distillers paid $7 billion in federal excise taxes while beer paid only $3.5 billion. On the state level, spirits pay $4.3 billion in excise taxes while beer pays $2.2 billion.

Distillers have to pay $13.50 in FET for every proof gallon they distill vs. brewers who only have to pay $5.81 for every proof gallon they brew.

FACT:

Spirits Sector Is One Of The Most Heavily Taxed Industries

When you factor in federal, state and local taxes, more than 52% of the price of a typical bottle of spirits goes toward a tax of some kind.

FACT:

More Than 1.7 Million Jobs Are Supported by the Spirits Industry

The spirits sector contributes $200 billion to the U.S. economy. The spirits industry is a major contributor to the U.S. economy supporting the manufacturing, hospitality, tourism and agriculture industries. The spirits industry also fosters job creation and supports small businesses in the agriculture, hospitality and tourism industries.

FACT:

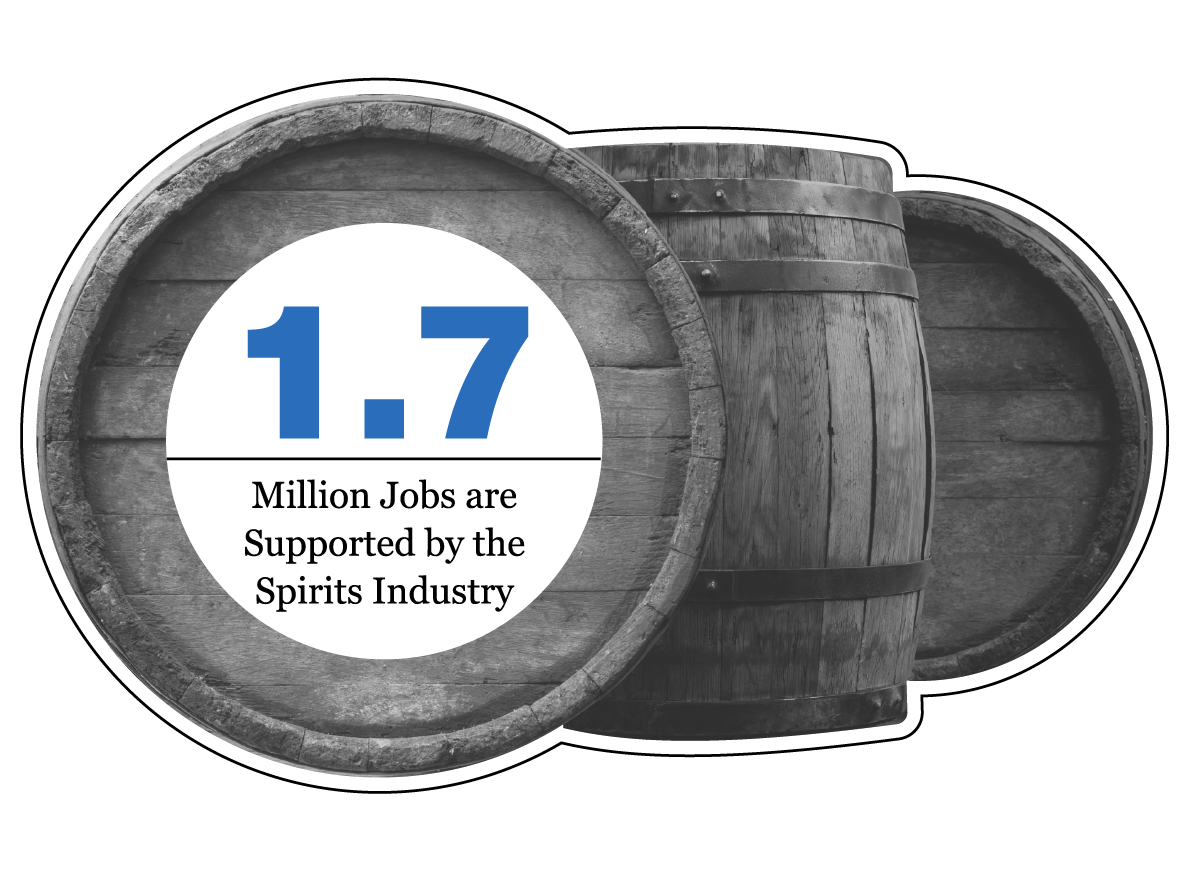

Big Beer Blocks Competition to Preserve Their Market Power

In addition to enjoying significantly lower taxes, beer lobbies to limit stores where spirits products can be sold. Beer is sold in 3.5 times more retail outlets than spirits. Consumers who enjoy spirits have roughly 200,000 less retail options to purchase their favorite products.

FACT:

Beer Prices Are Skyrocketing, Increasing at a Rate of 2.5 Times More Than Spirits

Beer’s suggestion that spirits companies are gouging consumers is outlandish. According to the U.S. Bureau of Labor Statistics, beer prices have skyrocketed by more than 16% in the first half of 2023 compared with the same period in 2019, which is two and half times the rate of the price increases for distilled spirits. In fact, beverage alcohol industry analyst Bump Williams recently reported the beer category has “priced itself out of competition compared to spirits and perhaps even wine.”

FACT:

Big Beer is Fighting to Keep Taxes High & Restrict the Sale of Spirits RTDs

Big Beer’s anti-consumer, anti-competitive effort to block consumers from accessing the products they want includes spirits-based ready-to-drink (RTDs) products. These products have a similar alcohol content as malt RTDs, yet big beer has worked to kill commonsense legislation that would lower taxes on these popular products and allow them to be sold in the same locations as malt RTDs.

In 45 states, spirits RTD cocktails are taxed at a higher rate, and this state-level tax disparity is on top of a federal-level tax disparity, where spirits RTDs are taxed at more than twice the rate of beer- and wine-based RTDs. Additionally, beer, including malt-based RTDs, can be sold in grocery and convenience stores in 40+ states. Meanwhile, spirits RTDs with the same or lower amounts of alcohol can only be sold in grocery and convenience stores in 29 states.

FACT:

Beer Dangerously Misleads Consumers by Claiming Beer is “Drink of Moderation”

The suggestion that beer is “safer” than other forms of alcohol is incredibly irresponsible. As the CDC notes, “It is the amount of alcohol consumed that affects a person most, not the type of alcoholic drink.”* According to the U.S. Dietary Guidelines for Americans, standard drink equivalents of distilled spirits, beer and wine all contain the same amount of alcohol. A standard drink is defined as a cocktail with 1.5 ounces of distilled spirits with 40% alcohol by volume (ABV), a 12-ounce beer with 5% ABV and a 5 ounce glass of wine with 12% ABV.

The amount of alcohol in a beer may be higher than 5%. Learn more at www.standarddrinks.org.

FACT:

Big Beer Is Making Baseless Claims About Vital Tax Provisions

The Rum Cover Over Program Supports Economic Development in U.S. Territories

The rum cover over is a longstanding program between the U.S. government and the territories of Puerto Rico and the U.S. Virgin Islands where the federal excise tax on rum sold in the U.S. is remitted to the territories for necessary government services, environmental protection and economic development.

Section 5010 Was Instituted to Avoid Inequitable Taxation

Since 1980, Section 5010 has been an important mechanism for providing more equitable tax treatment between the alcohol categories. Specifically, Section 5010 ensures any wine-based alcohol used in a spirts product is taxed at the wine rate, not the spirit rate.

In addition, Section 5010 says that any alcohol flavoring (e.g. vanilla) that does not exceed 2.5% of a distilled spirit’s total alcohol content is not taxed at the spirits rate.

The Spirits Industry is a Leader in Responsibility

The distilled spirits industry is a leader in promoting responsible alcohol consumption among adults and the elimination of impaired driving and underage drinking. Over 30 years ago, leading distillers founded Responsibility.org, a national not-for-profit dedicated to these important causes. Since the inception of Responsibility.org in 1991, drunk driving fatalities have decreased 26%, and lifetime alcohol consumption among our nation’s youth has dropped to a historic low of 55%. Despite this progress, we still have more work to do, and our commitment to eliminate drunk driving and underage drinking is stronger than ever.

Help us stand with consumers!

Be Part of the Distilled Spirits Community

We are a community of advocates united with a common goal to ensure adult consumers can enjoy distilled spirits where they want, how they want and when they want, responsibly.

If you are wondering if this community includes you, then the answer is unequivocally YES.

This is your official invitation to join our community through Spirits United. We need your help to tell lawmakers that we want the freedom to enjoy spirits!

Benefits of Becoming an Advocate:

- Advocacy & Policy Updates

- Latest from the States

- Regional & National Events

- Featured Cocktail Recipes

- Access to Spirits United Partners

- Legislation that Impacts YOU

Download the Fact Sheet