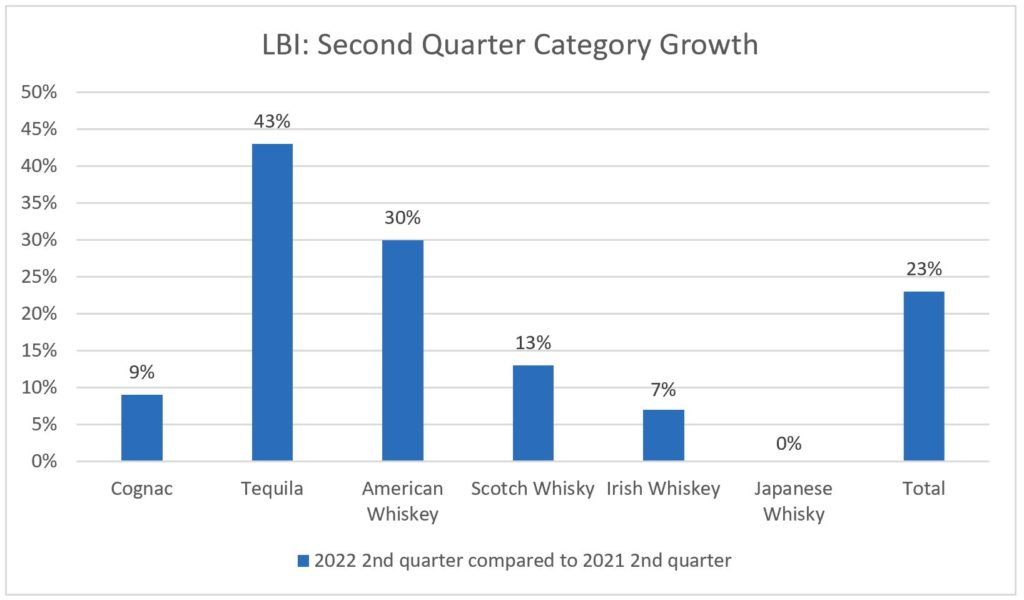

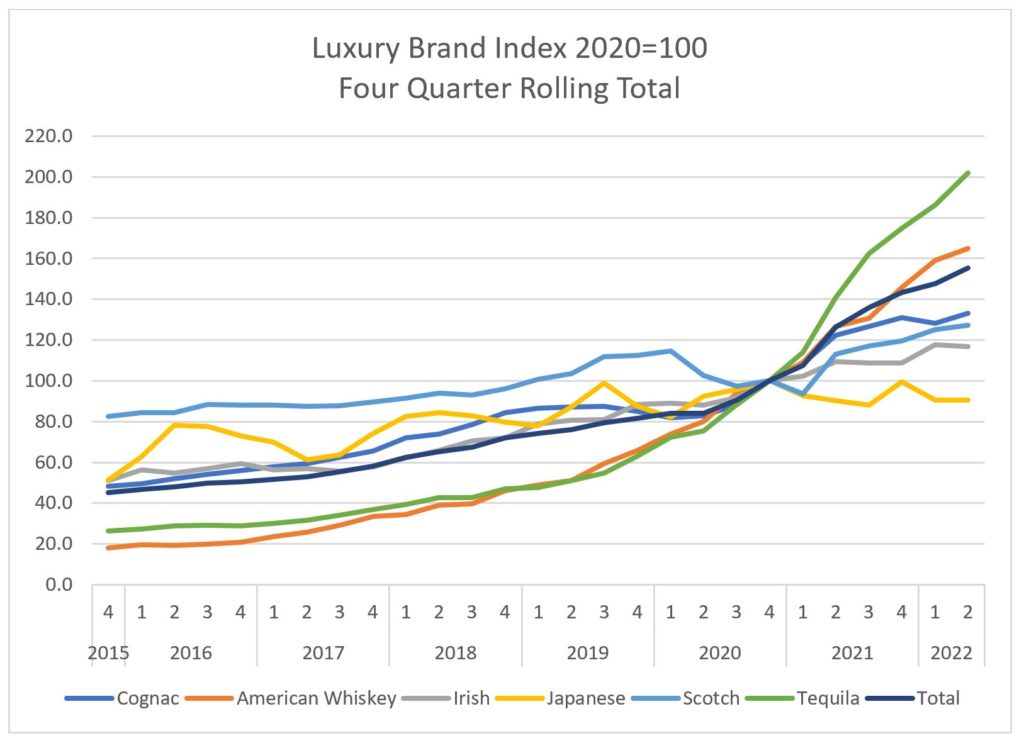

The Luxury Brand Index (LBI), a tool created by the Distilled Spirits Council of the United States (DISCUS) to analyze sales of spirits brands at the top end of the distilled spirits market, shows luxury brands grew 23 percent in the second quarter of 2022 compared with the same quarter of 2021.

DISCUS Chief of Public Policy Christine LoCascio stated that the positive trend is striking because it occurred despite the highest inflation in decades and negative economic growth in the second quarter of 2022.

“We continued to see strong consumer demand for luxury spirits brands through the second quarter of 2022 despite the current economic environment,” said LoCascio, noting that historically, the spirits sector has been resilient during tough economic conditions. “It appears macroeconomic headwinds slowed the astonishing growth rate of luxury spirits sales of 2021 but were not strong enough to reverse the positive premiumization trend. Distilled spirits are affordable luxuries that bring spirits consumers great joy. Consumers are willing to spend extra for that special spirit and choosing to drink better, not more.”

Key highlights of the LBI 2022 Second-Quarter Report include:

- Tequila showed the largest increase with 43 percent annual growth rate followed by American Whiskey that rose 30 percent.

- Scotch Whisky grew faster than the year-ago period with a 13 percent annual growth rate in the current period compared with a 10 percent growth rate in the year-ago period.

- After a very strong showing in the year-ago period with a 48 percent annual growth, Cognac was able to hang onto its gains with a 9 percent annual growth in the current period.

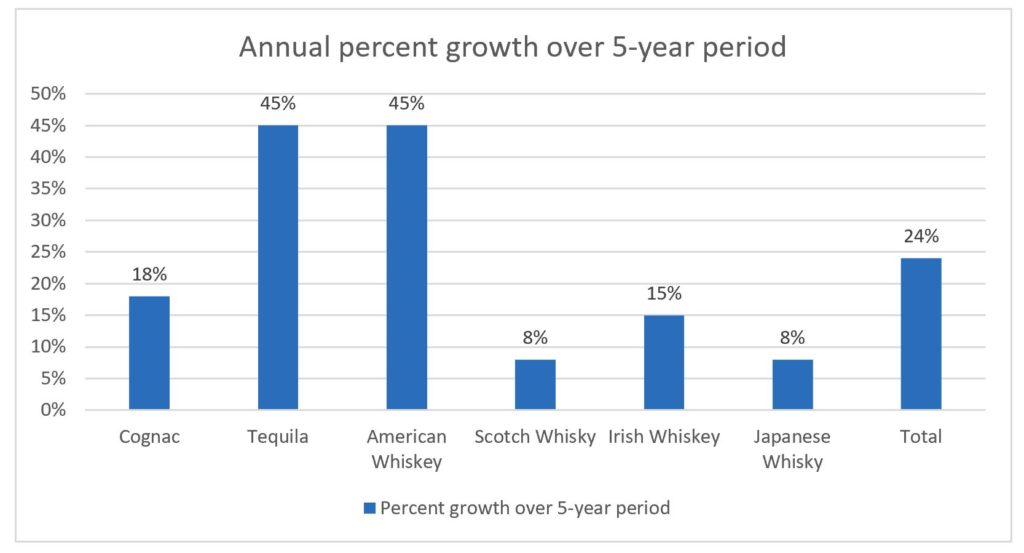

Over the five years between the second quarter of 2017 and 2022, all spirits categories included in the Luxury Brand Index increased annual growth ranging from 8 to 45 percent, with an average rate of 24 percent.

To see the full LBI second-quarter report, click here.

BACKGROUND

The LBI was first launched at the DISCUS Annual Conference in October 2021 and is released quarterly to provide insight to the beverage business community, analysts and media. The LBI tracks the performance of spirits brands that have a 750ml retail price of $50 or more. Retail prices were calculated by IRI Worldwide using retail scanner data. Volumes were derived from DISCUS’ proprietary brand data.