Index analyzes sales of spirits brands at the top end of the spirits’ market

The Luxury Brand Index (LBI), a new tool created by the Distilled Spirits Council of the United States (DISCUS) to analyze sales of spirits brands at the top end of the distilled spirits market, shows luxury brands grew 47 percent in the third quarter of 2021 compared with the same quarter of 2020.

The pace has been more than twice the annual average growth rate of 18 percent between 2015 and 2020.

“In addition to the premiumization trends of recent years, the pandemic forced many consumers to change the way they purchased and enjoyed their favorite spirits,” said Christine LoCascio, chief of public policy at DISCUS. “What resulted was a continued shift towards high-end spirits products and experimentation with cocktail creation at home. The restrictions brought on by the pandemic served as a catalyst for an already growing category in the spirits marketplace, and we are confident this trend will continue for holiday purchases.”

Key highlights of the LBI 2021 Third Quarter Report include:

- Tequila saw the biggest gains with 83 percent annual growth rate followed by American whiskey and Cognac at around 38 percent each.

- Following the removal of tariffs, Scotch whisky rebounded with a strong 20 percent growth rate after showing losses during 2020.

- Irish whiskey kept pace with the Scotch whisky by rising 19 percent.

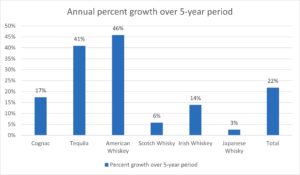

Over the five years between the third quarter of 2016 and 2021, all spirits categories included in the luxury index increased annual growth ranging from 3 to 46 percent, with an average rate of 22 percent.

The LBI was first launched at the DISCUS Annual Conference in October and is released quarterly to provide insight to the beverage business community, analysts and media. The LBI tracks the performance of spirits brands that have a 750ml retail price of $50 or more. Retail prices were calculated by IRI Worldwide using retail scanner data. Volumes were derived from DISCUS’ proprietary brand data.