What’s the Issue?

Outdated state laws are severely restricting Americans’ access to their favorite spirits ready-to-drink (RTD) cocktails. At the same time, spirits RTDs are taxed at a much higher rate than beer- and wine-based RTDs. It is time to modernize alcohol laws to allow equal access and fair tax treatment for spirits RTDs.

Americans’ Freedom of Choice is Being Restricted

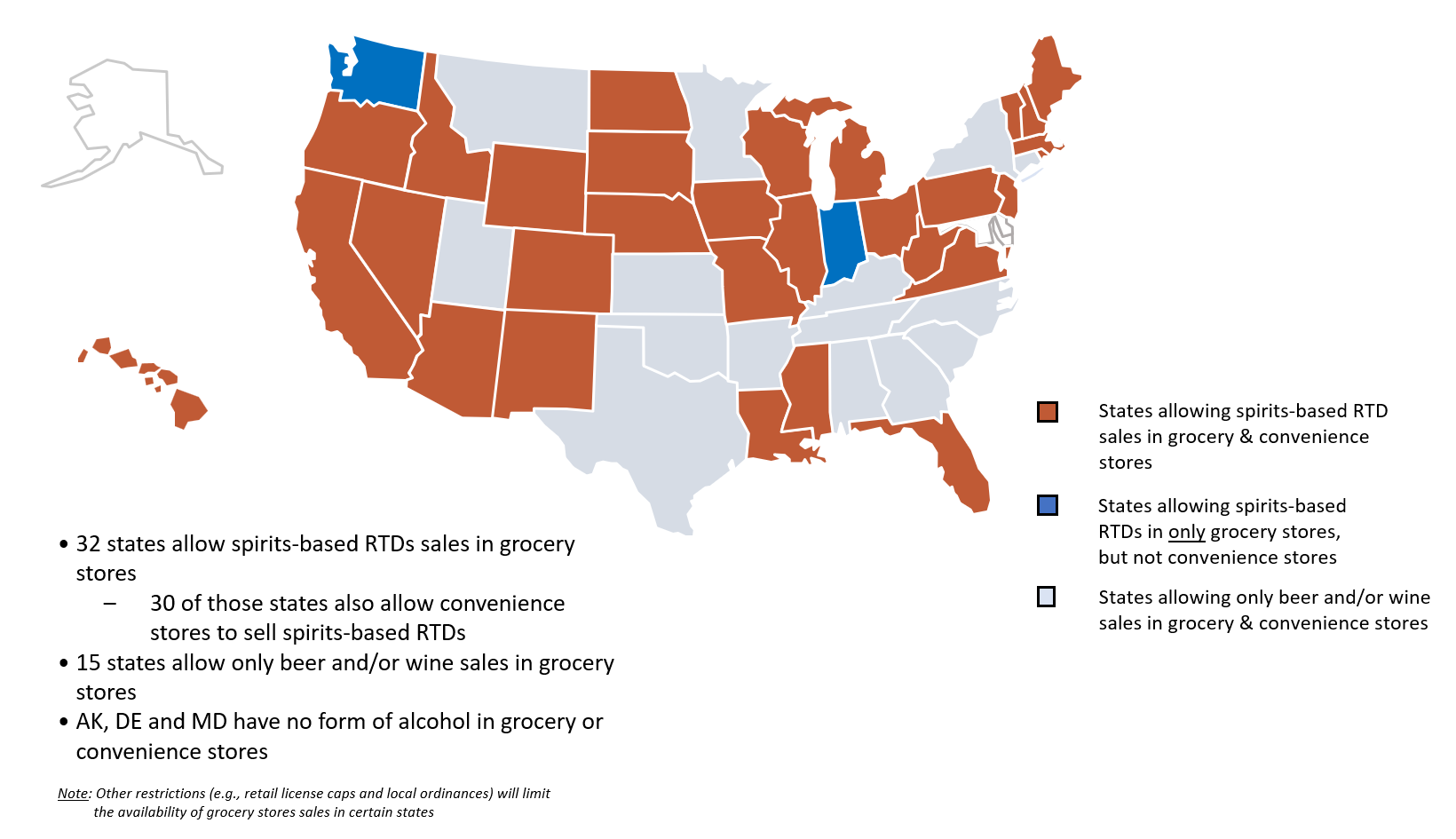

Eighteen states still prohibit the sale of spirits RTDs in grocery stores and 20 still ban it in convenience stores, even though these beverages have similar or lower alcohol content (alcohol-by-volume or ABV) than beer- or wine-based beverages.

For example, in Texas, spirit RTDs can only be sold in 3,000 package stores, while similar malt-based RTDs can be sold in more than 30,000 grocery and convenience stores.

Consumers have had enough. A recent national survey found that an overwhelming majority – 86% – agree that spirits RTDs should be sold where similar products are available, including in grocery and convenience stores.

Consumers have had enough. A recent national survey found that an overwhelming majority – 86% – agree that spirits RTDs should be sold where similar products are available, including in grocery and convenience stores.

Spirits Consumers and Small Businesses are Burdened with Higher Taxes

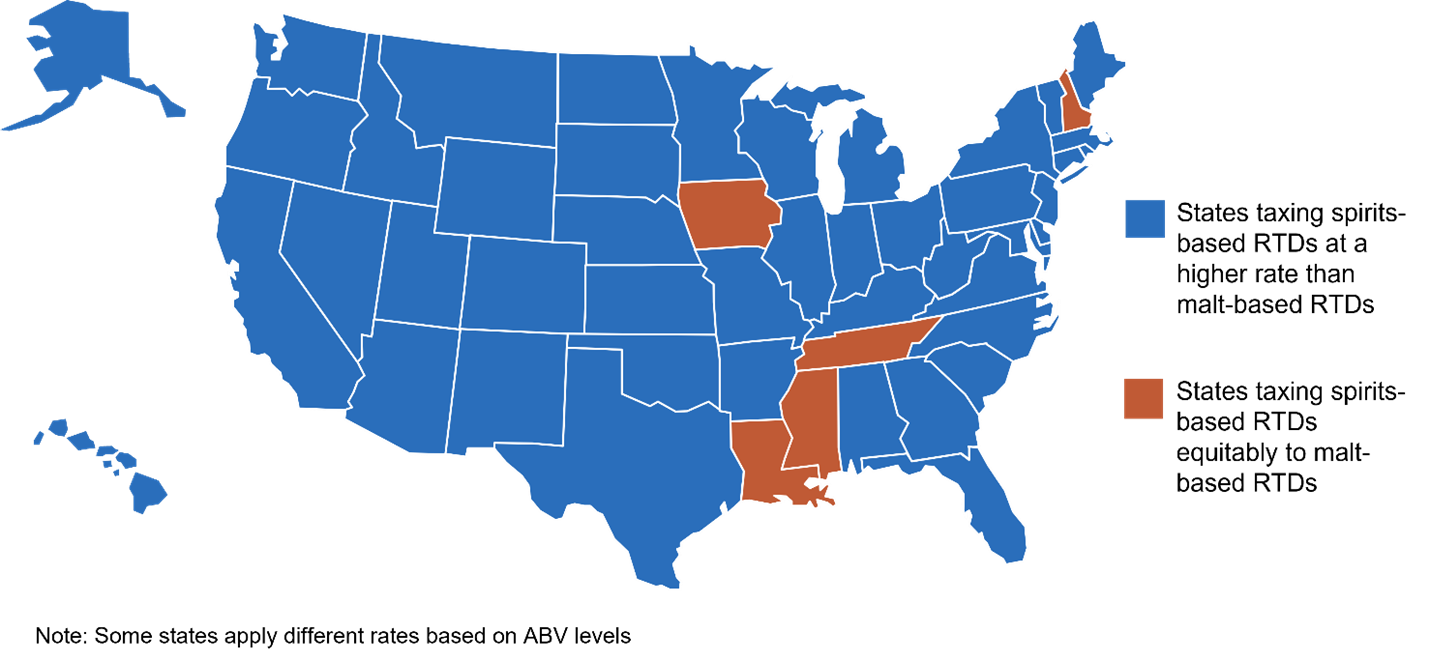

In 45 states, spirits RTDs are also being unfairly taxed at a much higher rate – sometimes as much as 55 times more than beer-based RTDs – even though these beverages have similar or lower levels of alcohol content. This excessive state tax disparity is on top of a federal tax disparity, where spirits RTDs are taxed at more than twice the rate of beer-based RTDs.

These discriminatory taxes are restricting small craft distilleries from expanding their businesses. Despite growing consumer demand for spirits RTDs, nearly two-thirds of craft distillers say they are not producing spirits RTDs due to higher tax rates. This keeps innovative, local products off the shelves, which hampers consumer choice.

Alcohol is Alcohol

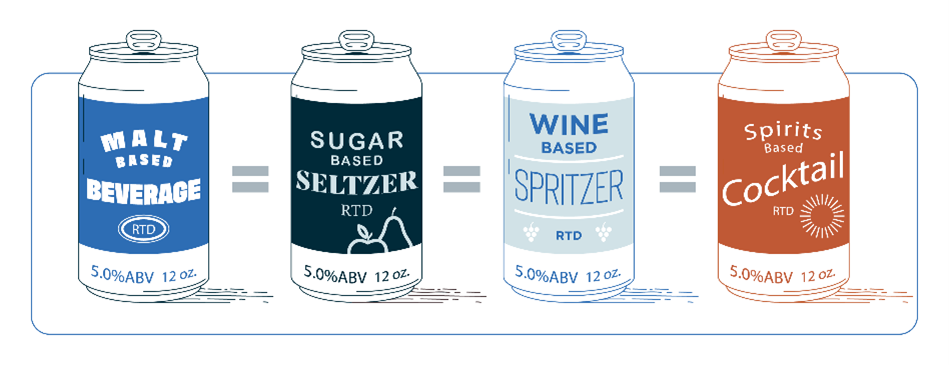

The reality is that alcohol is alcohol, and there is no scientific, public safety or public policy basis to differentiate between RTD beverages made from malt (beer), sugar, wine or spirits. A malt-based RTD with 5% ABV has the exact same alcohol content as a spirits RTD with 5% ABV. There is no difference.

Providing Equal Access and Fair Tax Treatment for Spirits RTDs Will Increase the Spirits Industry’s Already Significant Economic Impact

The distilled spirits industry is a significant driver of economic activity in the United States, contributing to the vibrancy of the manufacturing, hospitality, tourism and agriculture industries.

The U.S. Distilled Spirits Industry

Providing equal access and fair tax treatment for spirits RTDs will allow the industry to contribute even more, enabling the nation’s more than 2,600 craft distilleries – almost all small businesses – to expand and sell more products, which will generate more tax revenue and economic activity.

What’s the Solution?

It’s time for state legislators to CAN these outdated state laws – many of which date back to the Prohibition in the 1930s – to allow equal access and fair tax treatment for spirits RTDs.

Expanding access and providing a fairer tax treatment will:

- Increase consumer convenience and choice;

- Level the playing field for craft distillers wanting to enter the market;

- Raise state tax revenue;

- Support local businesses; and

- Enhance local tourism and hospitability.

Learn More About How Spirits Impact Your State